APY: tags annual percentage yields from lending protocols across Ethereum’s ecosystem of dApps.Each one makes the yield aggregation happen: Yearn Finance is a collection of smart contracts working together to simplify yield farming. To pay for the protocol’s continued development, Yearn Finance charges withdrawals, as 0.5% fees.

Thanks to these YF tools, investors can shop for the best interest rates available. Decentralized exchanges (DEXs) like Uniswap need liquidity for exchanging token pairs, which also generates interest rates for liquidity providers. Of course, liquidity providers (LPs) are not constrained to just lending platforms to engage in yield farming. In addition to making DeFi accessible to the average online adventurer, Yearn Finance deployed a number of custom tools to serve as a yield aggregator for the largest lending platforms: Aave, Curve, Balancer, and Compound. As a talented programmer, Andre Cronje automated this process and scaled it up for public consumption in the form of Yearn Finance. Without Yearn Finance, investors would have to manually move their liquidity into the protocol that has the highest return rate. To keep up with the spirit of decentralized finance, Cronje chose not to reserve any YFI tokens for himself. Moreover, Cronje didn’t even raise funding, private or public, through YFI token sales. Interestingly, Yearn Finance is one of the rare projects that was not funded by venture capital firms. The platform’s goal is to simplify the DeFi experience, so crypto investors don’t have to hunt down yields across dozens of lending dApps. Yearn Finance’s popularity mirrors its main mission.

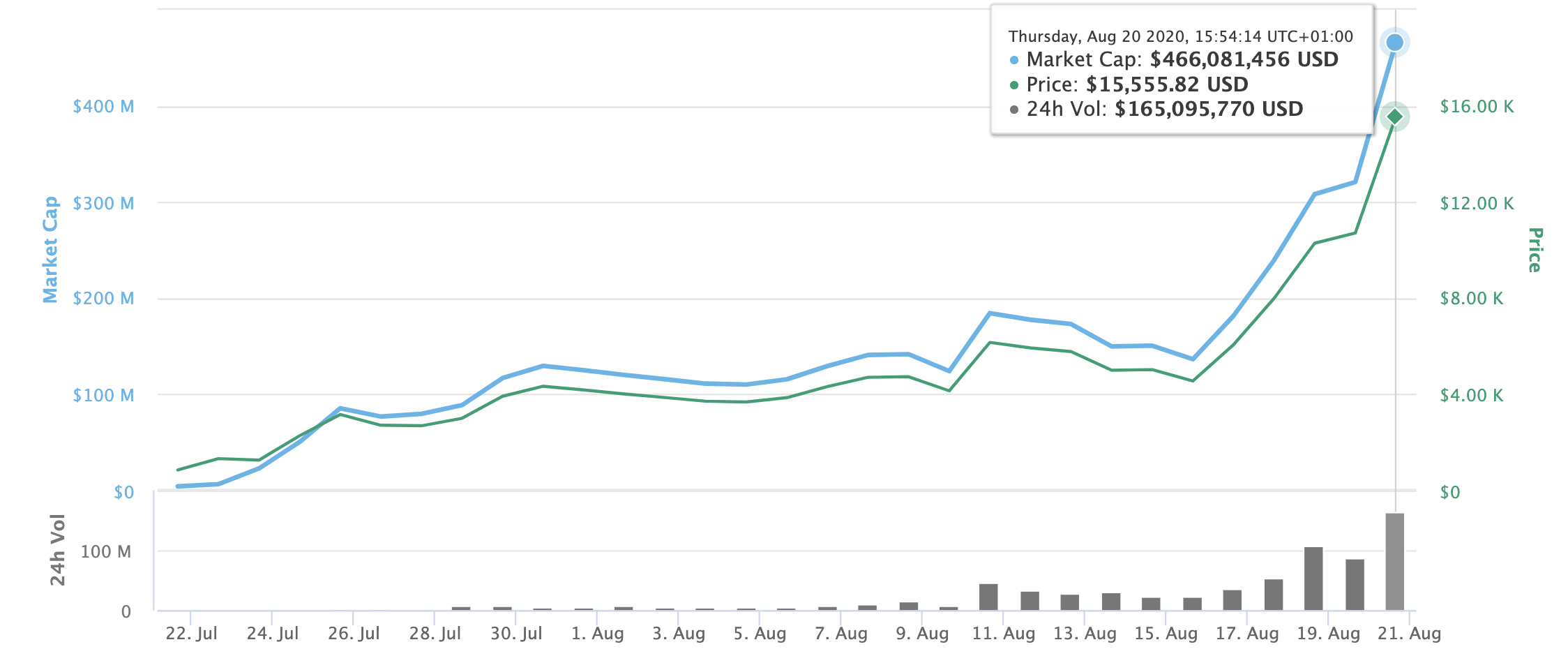

Yearn Finance: darker blue is total value locked (TVL), while light blue is YFI market cap. After iEarn showed success in yield aggregation, Cronje renamed it to yEarn, as in yield earn, which finally morphed into Yearn Finance (YFI) in July 2020.Īt its TVL peak in December 2021, Yearn Finance held $6.91B worth of crypto funds, an incredible 103,034% growth since July 2020. Instead, smart contracts, hosted on blockchain networks, serve as liquidity depositories for lenders and as liquidity sources for borrowers.Īt each side of the equation, borrowers and lenders interface with smart contracts. In traditional finance, this approach would entail moving money between accounts to pocket interest returns.

0 kommentar(er)

0 kommentar(er)